Rapidly assess, control, and improve receivables performance in turnaround, contingency and special situations. Get critical insight, automate action, and protect value from day one.

Invevo gives advisory and restructuring teams a single, intelligent platform to manage receivables in distressed or underperforming businesses. Whether advising on operational improvement, working capital recovery or full financial restructuring, our AI-first AR platform delivers the control, speed and transparency needed to increase cash performance and working capital fast.

Ingest and normalise AR data from SAP, Oracle, Sage, NetSuite and more—no transformation project required.

Use out-of-the-box workflows to action collections, risk controls and stakeholder communications immediately.

Coordinate activity across finance teams, advisors, lenders and execs—on one platform, with audit trails.

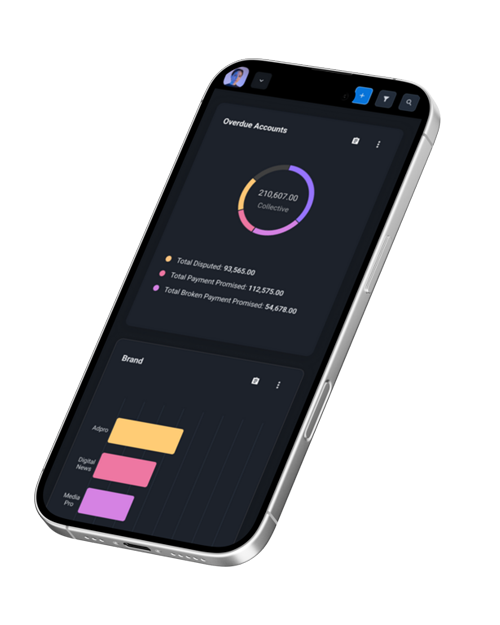

Track DSO, dispute volumes, ageing, and risk exposure—down to debtor, region or team level.

Apply AI-driven collections, dunning, dispute resolution and credit risk monitoring tailored to turnaround conditions.

Visualise debtor book performance across your multiple engagements, to fine tune operational processes that deliver quick working capital improvements.

Assign and escalate AR tasks to internal or external teams, with queue management and prioritisation logic.

Enable customers to self-serve payments, raise issues, or request plans—branded and live in days.

Advisors & Consultants

Restructuring Teams

Operational Finance Teams

Creditors, Lenders & Stakeholders

Any Language

Any Currency

Unlimited Users

Live in 60+ Countries

Whether stabilising a distressed asset, supporting a contingency plan, or driving creditor confidence—Invevo gives restructuring professionals the tools and data to act fast and deliver results.

Global Head of Collections @ The Adecco Group

“With Invevo, we’ve gained the live credit information and business insight needed to make data-informed decisions, be proactive rather than reactive, deliver money in the bank and keep Adecco ahead of the competition.”

O2C Global Process Owner @ Informa

“Invevo created a bespoke solution to meet the unique needs of each part of our business—something most solutions can't handle. Now, our accounts teams follow a consistent and traceable process, regardless of location or business unit.”

National Credit Risk & Data Manager @ City Plumbing

“Thanks to Invevo, we are finally equipped with everything we need to run a more efficient business. Finally, we are no longer struggling to force an outdated system to keep up with our changing business needs.”

Head of Group Credit Control @ Access Intelligence

"With Invevo’s help, we’ve been able to vastly improve on our existing system. The way we do things is much more efficient and organised now, making workloads much more manageable for the whole team."