Gain real-time visibility and control over collateral performance. Track, manage, and optimise recoveries and collections across your funded portfolio—from one secure, scalable platform.

Invevo gives asset-backed lenders the ability to unify borrower AR data, track exposures in real-time, and automate recovery workflows. Whether you're funding a single borrower or managing a multi-entity portfolio, our AI-first AR platform enhances oversight, reduces risk, and drives accelerated repayment outcomes.

Ingest AR and collateral data directly from borrower ERPs—SAP, Oracle, Sage, NetSuite, and others—into a single control tower view.

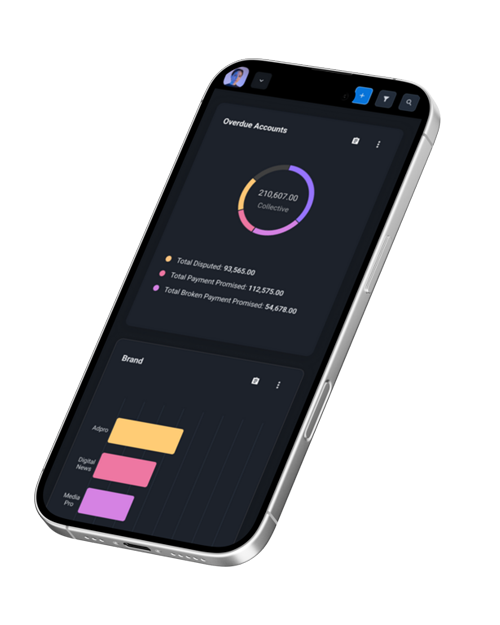

Deploy pre-configured dashboards for covenant tracking, receivables age bands, and borrower performance benchmarks.

Enable borrowers to submit, view, and manage AR performance directly, while giving lenders oversight and alerting in real time.

Track collateral coverage, concentration risks, overdue positions, and drawdown risk with automated alerts and insights.

Set thresholds and alerts for ageing, overdue percentages, concentration, or dilution risk—across all borrowers.

Consolidate performance at lender, borrower, or facility level with configurable dashboards and daily updates.

Streamline AR uploads and monthly reporting with structured intake workflows and validation rules.

Empower end customers to pay, settle or engage via borrower-branded portals—accelerating repayment.

Credit & Risk Officers

Portfolio Managers

Borrowers (Finance Teams)

Servicer's & Advisors

Any Language

Any Currency

Unlimited Users

Live in 60 Countries

Whether you're funding fast-growing SMEs or managing large, structured facilities, Invevo gives you the data, tools, and automation to protect your position and optimise recovery.

Global Head of Collections @ The Adecco Group

“With Invevo, we’ve gained the live credit information and business insight needed to make data-informed decisions, be proactive rather than reactive, deliver money in the bank and keep Adecco ahead of the competition.”

O2C Global Process Owner @ Informa

“Invevo created a bespoke solution to meet the unique needs of each part of our business—something most solutions can't handle. Now, our accounts teams follow a consistent and traceable process, regardless of location or business unit.”

National Credit Risk & Data Manager @ City Plumbing

“Thanks to Invevo, we are finally equipped with everything we need to run a more efficient business. Finally, we are no longer struggling to force an outdated system to keep up with our changing business needs.”

Head of Group Credit Control @ Access Intelligence

"With Invevo’s help, we’ve been able to vastly improve on our existing system. The way we do things is much more efficient and organised now, making workloads much more manageable for the whole team."